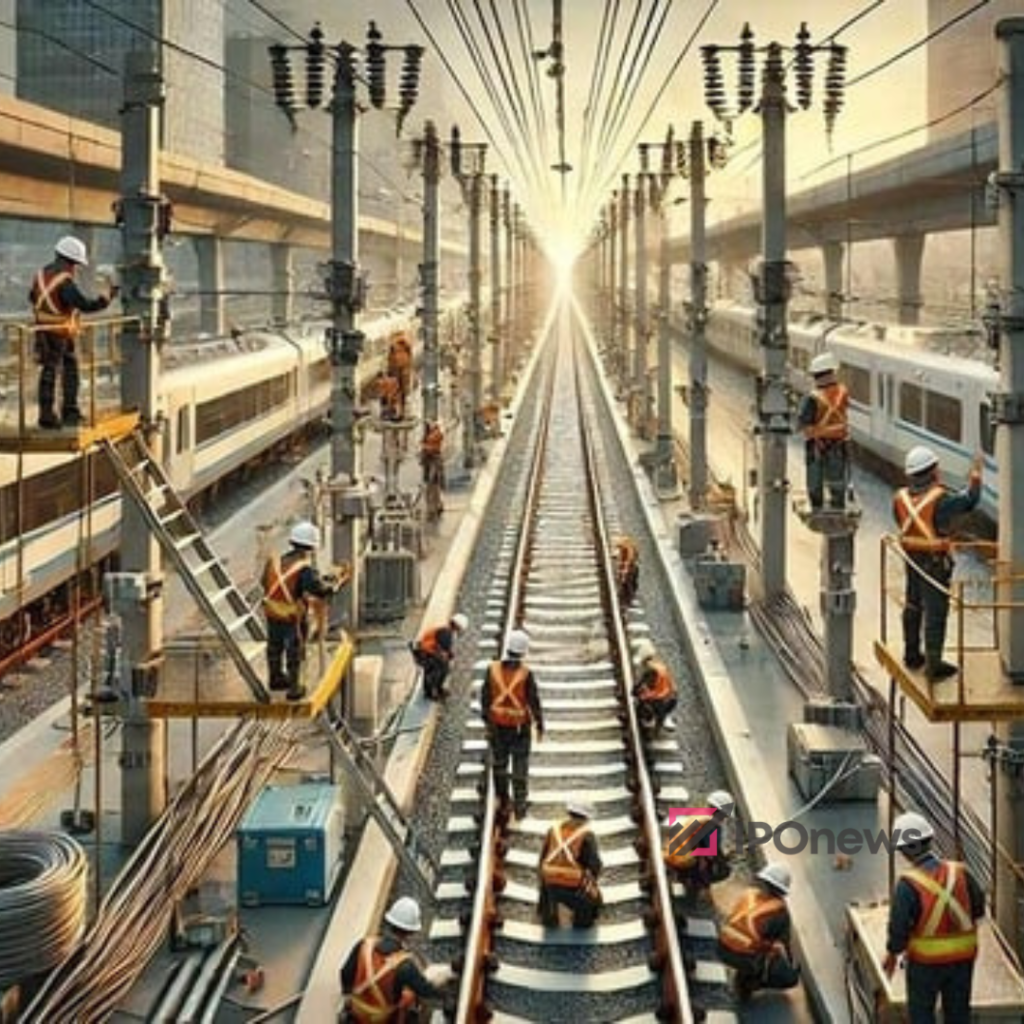

Quadrent Future Tek is a research oriented company that develops new generation train control and signaling system under KAVACH project. Its manufacturing facility is located at Vilage Basma Tehsil Banur, Mohali for manufacturing, testing, researching, and developing all the products. It also manufactures speciality cables that is used in Railway rolling stock, Naval ship vessels & submarines, electric vehicles and fuel cell electric vehicles. These cables are also used in Solar and wind installation.

Its Specialty Cable Division has received many accreditions namely, NQA certification and ROHS Certification. As of Sep 30, 2024, it has an installed specialty cable capacity of 1,887.60 metric tonnes. And for train Control & signaling division, it has an installed capacity of 4,492 Station TCAS, 2,264 Locomotive TCAS and 3,744 Remote Interface Unit.

Quadrant Future Tek IPO open date is January 7, 2025 and the IPO will close on January 9, 2025. Quadrant Future Tek IPO price band is ₹275 to ₹290 per share. The retail quota is 10%, QIB is 75%, and HNI is 15%.

Quadrant Future Tek IPO to list on BSE, NSE on January 14, 2025. The allotment of Quadrant Future Tek IPO date is January 10, 2025. The company reported revenue of ₹151.82 crores in 2024 against ₹152.95 crore in 2023. The company reported profit of ₹14.71 crores in 2024 against Profit of ₹13.90 crores in 2023.

Quadrant Future Tek IPO Details

| IPO Open Date: | January 7, 2025 |

| IPO Close Date: | January 9, 2025 |

| Face Value: | ₹10 Per Equity Share |

| IPO Price Band: | ₹275 to ₹290 Per Share |

| Issue Size: | Approx ₹290 Crores |

| Fresh Issue: | Approx ₹290 Crores |

| IPO Listing: | BSE & NSE |

| Retail Quota: | Not more than 10% |

| QIB Quota: | Not more than 75% |

| NII Quota: | Not more than 15% |

Quadrant Future Tek IPO Timeline

The Quadrant Future Tek IPO date is January 7, 2025 and the close date is January 9, 2025. The Quadrant Future Tek IPO allotment will be finalized on January 10, 2025 and the IPO listing on January 14, 2025.

| IPO Open Date: | January 7, 2025 |

| IPO Close Date: | January 9, 2025 |

| Basis of Allotment: | January 10, 2025 |

| Refunds: | January 13, 2025 |

| Credit to Demat Account: | January 13, 2025 |

| IPO Listing Date: | January 14, 2025 |

Quadrant Future Tek IPO Lots

| IPO Activity | Date |

|---|---|

| Issue Price | ₹275.00-290.00 |

| Market Lot: | 50 Shares |

| 1 Lot Amount: | ₹14500 |

| Min Small HNI Lots(2-10 Lakh): | 700 shares (14 lots) – ₹203000 |

| Min Big HNI Lots(10+ Lakh): | 3450 shares (69 lots) – ₹1000500 |

Quadrant Future Tek Ltd: Financial Data and Market Position

| Period Ended | 30 Sep 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 149.66 | 142.82 | 118.82 | 112.77 |

| Revenue | 65.14 | 151.82 | 152.95 | 104.29 |

| Profit After Tax | -12.11 | 14.71 | 13.9 | 1.94 |

| Net Worth | 34.18 | 44.11 | 29.42 | 15.61 |

| Reserves and Surplus | 4.18 | 34.11 | 19.42 | 5.61 |

| Total Borrowing | 98.01 | 81.61 | 74 | 80.68 |